The Buying Process:

How to Enter the real estate market

Understanding the local real estate market

Determining your budget and getting pre-approved .

It’s important to know how much you can afford before you begin actively looking for a house. It’s very tough looking at homes you cannot afford. If you end up liking one and cannot get buy the home it can be heartbreaking.

How do you get pre approved?

We have a few experienced mortgage lenders who can answer your questions and guide you thru the loan process and get you pre approved so we can help you find act on a home once you find your dream house.

What will the lenders want from me?

Employment history

- Credit reports

- Financial documents

- Annual income

- 1099 income, self employed Ect

This will determine the interest rate the lender will charge the buyer and offer the borrowing loan options such as FHA-VA-Conventional, Will the seller offer contract for deed financing if I cannot get approved? Some sellers will offer owner financing but most want to cash out. Contact us we can help guide you thru this process if you cannot get a mortgage the traditional.

Types of loans

VA loans are backed by the Department of Veteran’s Affairs, and they are guaranteed to qualified veterans and active-duty personnel and their spouses. VA loans can be approved with 100 percent financing, meaning VA borrowers are not required to have a down payment. Unlike FHA loans, borrowers do not have to pay mortgage insurance on VA loans, but may be subject to a funding fee (paid by the seller or rolled in to the loan).

FHA

FHA loans are insured by the Federal Housing Administration and are typically designed to meet the needs of first-time homebuyers. FHA loans require a down payment of as little as 3.0 to 3.5 percent of the sale price of the home. Because the agency is taking on more risk by insuring these loans, the borrower, are expected to pay mortgage insurance and the property must be owner-occupied. An FHA mortgage insurance premium (MIP) is calculated annually.

Conventional

Credit Score. Credit score requirements for conventional mortgages vary by lender; however, in most cases the minimum credit score for a conventional mortgage is 620. Some lenders, however, will underwrite mortgages with credit scores as low as 580; it is simply up to each lender as to what score is the cutoff.

Contract for deed programs:

Contract for deed is an alternative financing agreement in which the seller finances the sale of the property instead of a lender/Bank.Credit union Ect. The Home buyer takes possession of the home after the closing of the sale.

Contract For Deed – Minneapolis MN Real Estate & Homes For Sale

Who utilizes contract for deed financing?

- Bankruptcy

- Short Sale or in the process of foreclosure

- Foreclosed property

- Lack of credit

- Bad credit

- Self employed

- Cant prove income

- 1099 employed

- Relocation

- turned down by a lender

- sick of renting

- tax benefits

- appreciation

- Can keep fido-no renting

Draw backs of a contract for deed financing:

- If the buyer does not pay the seller can cancel the contract in Minnesota in 60days which is quicker than a stand mortgage foreclosure.

- Higher rates than a mortgage

- Investors charge a premium for buying properties. They range from 4% to 10%.

- Shorter financing 3-5 years on average verses a 30 year mortgage.

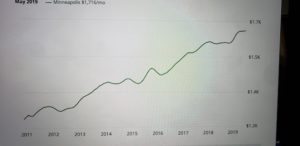

Minneapolis housing stats. Home prices have risen since 2013

Down payment assistance?

The Minnesota Housing Finance Agency (MHFA) and the Wisconsin Housing and Economic Development Authority (WHEDA) have several programs that help first-time and repeat homebuyers with down payments and other home buying costs. Income, credit and home cost limitations exist.

Mortgage gift funds:

Down payments can be gifted by parents, grandparents or other close family, but it’s important to record and track these funds at the direction of your lender because they can impact loan eligibility.

Hiring BoardWalk Premier Realty

We only get paid if we successfully close on a sale of the property the buyer purchases. The seller pays the real estate commission the the listing broker and the buyers broker. and Our commission rate is agreed upon by the Realtor ( listing agent) and the home seller. This means that if you are buying a home, you likely won’t have to negotiate the commission rate of your real estate agent. Realtors risk it all and the buyers reap the benefits of the knowledge and negotiating skills of the Real Estate Agents in Minnesota. Don’t go at it alone and take chances when you can have BoardWalk Premier Realty work for you today,

Finding your dream Home:

First Identify the community you want to live in.

What cities and neighborhoods do I feel comfortable in?

- How long will my commute to work or activities be?

- How far away are major highways

- Is there a grocery store close by? What about a gym? Coffee shop?Walmart?Costco?

- Are there playgrounds, parks, trails or nature areas nearby?

- Are the school districts rank?

Where do you want Your home search start at?

Things you Must-have features?

Once you know the community you would like to live in. Its time to look the things you want to have.

What is the most important features you would like to have? How bedrooms-bathrooms and square footage, fenced yard-lake front-acreage.

Can you have animals-live stock?

Then make a list of must-have features like an updated kitchen, hardwood floors or central heating and cooling.

Do you want a home that’s move-in ready, or are you willing to undertake a fixer- upper?

Determining where you want to live?

Do you want to live in the city, country? Or would you want to live on a waterfront property like a lake -river property-cabin?

Does the lake have to be a full recreational lake or can it just be a thing of beauty to view.

Which property type is right for you and what are they?

Single-family homes :

The owners own a stand-alone structure that may or may not share any essential facilities Some communities have recreational areas such as a playground or pool area.This property type typically has direct access to the street and the entire space or lot around the building is private to the owner.

Townhomes :

The owners own their individual housing unit as well as the ground beneath that unit. Similar to condo owners, townhome residents belong to a homeowners’ association (HOA) and pay fees for the general maintenance of common outdoor areas. Townhomes are usually a series of units that are linked to each other by common walls.

Condos:

The owner owns the space within their individual unit. The common areas of the property, such as the land beneath it and the building structure, are owned jointly by all the unit owners. Each of the condo owners within a property belong to an HOA which manages the complex and collects association fees to maintain the common areas. Because unit owners do not own the land beneath their unit, condo units are often stacked on top of each other.

Things to to think about when buying a town home or condo A prohibition or limitation on pets.

- Restrictions on how your unit can be altered or improved.

- Limitations on renting the property.

- Not allowing the property to be used for a home business.

Townhomes and condos in Minnesota are subject to a set of laws called the Minnesota Common Interest Ownership Act, which gives purchasers a 10-day right to cancel their to

cancel their purchase agreement following receipt of documents about the association provided by the seller purchase agreement following receipt of documents about the association provided by the seller.

Should you Attend open houses?

We don’t recommend attending the open houses. You will find the realtor working there that represents the seller. We would rather walk you thru the property and go over the positive and negatives of the home with you freely .

How do I make the most of showings?

We recommend taking notes as we walk thru the properties and do a positive and negative list and can go over all the features with you.

How do I make an offer?

Here are factors you should discuss with your Boardwalk Premier Realtors when considering making an offer.

- How many Days on market?

- Price

- Past offers

- Closing dates

- Terms are the only willing to do bank financing or will they accept a contract for deed?

- Whether they are currently negotiating or considering offers?

- What the seller will not consider?

- Whether there have been previous canceled purchase agreements • What updates have been made?

- Why the sellers are moving ?

- Is there a truth n housing report? Some cities in Minnesota require a truth n housing inspection report.

- View the sellers disclosures

- Recent sold. What is the agents opinion on the price?

How much Earnest money do I have to put down?

As a part of your offer, you will submit an earnest money deposit. This deposit is put into the trust account of the seller’s broker, where it is held until closing. The deposit is then applied to the sale. Earnest money is an indication to the seller that you are committed to buying their home and a more significant deposit can indicate a higher level of commitment to the home. The more Earnest money down can make a difference in your offer being accepted in a multiple offer situation.

When should I make my Closing date?

The more flexible you are with a closing date the better chance of your offer will be accepted with the seller. We would ask the seller what closing date works best for them and coordinate it with the buyer to make sure it works for both parties.

What are contingencies?

These are the most common Contingencies.

Contingent, subject to inspection

The buyer and seller have signed a purchase agreement, but the buyer is allowed to cancel if the buyer does not like the results of the home inspection. I recommend the buyer uses a licensed home inspector.

Contingent, sale of another property

The buyer and seller have signed a purchase agreement, but the buyer is allowed to cancel if the buyer’s own home does not sell.

Contingent, subject to third party approval

The seller’s lender must approve the sale if the sale proceeds will not be sufficient to pay off the seller’s mortgage loan. This is sometimes called a short sale.

Contingent on seller finding their next home.

The seller signs a purchase agreement as the buyer of another home.

What happens After my offer is accepted?

Do I need to do a final walk-through before closing?

We recommend the buyer does a final walk thru before closing to ensure that all the changes negotiated from the inspection have been completed and to make sure that everything is in the condition it should be. The home buyers can test the appliances, water system, Septics-well pumps, electricity, heating and cooling, fixtures, Doors, windows. You should also make sure items you expected to remain are still in the home, including window treatments, shelving units and other items included in the purchase agreement.

What is an Appraisal and who pays for it?

The home buyer pays for the appraisal.

How to Prepare to for your move?

Research moving companies, obtain bids and schedule the movers in advance Research area schools “if it applies to you” doctors and dentists; have files transferred

Make sure to keep key financial documents, warranties and tax records accessible in a separate box

Have your address changed (mail, bank accounts, magazines, insurance, cell phone.

Contact your utility companies (phone, water, electric, cable, internet, security systems. to inform them of your move and set up connectivity at your new home

The closing process and what can I expect?

Purchase agreement is signed by all parties

Buyer meets with mortgage loan officer to complete the mortgage approval process

Closing date and time are scheduled

Buyers submit the personal information that is needed to close

Title company prepares closing documents and submits to lender for approval of the final settlement statement; once approved, buyer receives final costs of purchase

Payment is made (a cashier’s check) or wired funds. DO NOT WIRE ANY MONEY WITH OUT YOUR REALTORS CONSENT” LOTS OF FRAUD OUT THERE.

Deed is submitted by title company to the county for recording and homeowner’s title insurance policy is issued, if applicable

A copy of the deed, after it is recorded with the county, is sent to the buyer

Do I need to buy Title insurance?

Your lender will require you to buy lender’s title insurance, which protects the lender’s interest in your property.

You’ll also have an option to purchase owner’s title insurance, which protects you against hidden claims on the property or claims that the title is invalid.

Some title issues such as liens, easements or bills left behind by a previous owner may not be discovered until months or even years after a property is purchased—even with the most diligent search.

The title insurance required by your lender prior to closing protects the lenders only. Owner’s title insurance protects you by paying for all attorney’s fees and court costs in addition to the costs associated with removing the lien or other covered claim from your title.

Understanding the local Real Estate Market.

Is it a buyers or sellers market? How do I know?

By Understanding the current inventory of homes available is a critical element to determining who holds the advantage in a home search and negotiation–you as a buyer, the seller or neither buyer nor seller.

What is a Sellers’ market?

When there are fewer homes for sale (low supply), the demand grows because buyers are forced to compete with each other for those homes. In times of high demand for homes, sellers can often get a higher price, either by increasing their asking price according to comparable sales or by receiving multiple offers.

Buyers’ market: When there are many homes for sale (high supply), buyers have more choices, more time and less competition, so the demand for homes drops, as do prices. Sellers may also offer Contract for deed financing when this happens.

Minneapolis rental market.

Home rentals have gone up drastically since 2011. The average Rent is over $1700 month. That should be motivation itself to purchase a home. Contact us today!

zillow.com/profile/Steve-Vennemann/#reviews

Zillow Minneapolis

The median home value in Minneapolis is $266,300. Minneapolis home values have gone up 3.4% over the past year and Zillow predicts they will rise 1.4% within the next year. The median list price per square foot in Minneapolis is $273, which is higher than theMinneapolis-St. Paul-Bloomington Metro average of $206. The median price of homes currently listed in Minneapolis is $320,000 while the median price of homes that sold is $265,800. The median rent price in Minneapolis is $1,850, which is higher than theMinneapolis-St. Paul-Bloomington Metro median of $1,750.

Foreclosures will be a factor impacting home values in the next several years. In Minneapolis 2.0 homes are foreclosed (per 10,000). This is greater than the Minneapolis-St. Paul-Bloomington Metro value of 0.8 and also greater than the national value of 1.2

Mortgage delinquency is the first step in the foreclosure process. This is when a homeowner fails to make a mortgage payment. The percent of delinquent mortgages in Minneapolis is 0.5%, which is lower than the national value of 1.1%. With U.S. home values having fallen by more than 20% nationally from their peak in 2007 until their trough in late 2011, many homeowners are now underwater on their mortgages, meaning they owe more than their home is worth. The percent of Minneapolis homeowners underwater on their mortgage is 6.3%, which is higher than Minneapolis-St. Paul-Bloomington Metro at 5.0%.